Leon Fuat Berhad Records Stellar Quarter due to Rising Global Demand, Profit Up 3,297%

|

|

|

|

Improved Revenue and Profit Margins

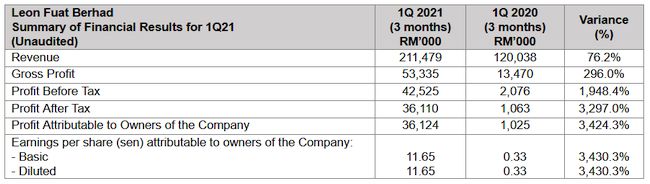

The gross profit recorded a 296.0% increase to RM53.34 million for 1Q2021 compared to the RM13.47 million in gross profit for the corresponding quarter of the previous financial year due to the 9.4 percentage points rise in gross profit margin for trading of steel products to 22.2% while gross profit margin for processing and/or manufacturing (collectively referred to as "processing") of steel products increased by 16.4 percentage points to 26.8%.

Overall revenue increased by 76.2% to RM211.48 million in 1Q2021 compared to the RM120.04 million in the corresponding quarter of the previous financial year. On a segmental basis, revenue from trading of steel products increased by 87.5% to RM74.29 million for the quarter under review while revenue from processing of steel products increased by 70.7% to RM137.11 million. The trading segment share of revenue contribution stood at 35.1% in the quarter under review while the processing segment's share of revenue contribution stood at 64.8%.

Rising Steel Prices Worldwide Due To Global Demand

Calvin Ooi Shang How, Executive Director of Leon Fuat said: "We are pleased to be able to achieve such favourable result this quarter. Steel prices have been advancing worldwide since the second half of 2020 on the expectations of an improving global economic outlook. There is a global steel boom underscored by strong demand with prices rising to a multi-year high. Nevertheless, while steel prices show no sign of coming off anytime soon, we are cautious, both for the outlook on prices and the economy as the COVID-19 pandemic shows no sign of abating."

"Given the uncertainties surrounding the pandemic, much will continue to depend on how well key economies around the world can recover and the effect this will have on steel demand and prices. Volatile commodity and crude oil prices will continue to have an impact on the ringgit, with these factors affecting the profitability of our steel products given that most of these products are sourced from overseas. We aim to strive for sustainable growth and will continue to monitor steel prices as well as related foreign currencies and will take proactive measures including negotiating forward contracts, prudent inventory management and cost-management to mitigate any negative impact."

"We have and will continue to actively address all concerns relating to COVID-19 in regards to our employees and the business operations. This is on top of adhering to all MCO regulations and other standard operating procedures from the National Security Council. The Group has in place emergency response teams ("ERT") in three of its subsidiaries and is considering a group-wide ERT."

Leon Fuat recently completed a private placement exercise where funds raised will be invested into business expansion and purchase of new machineries to meet customer's orders. As of today, Leon Fuat's share price closed at RM1.06 with a market capitalisation of RM361.46 million.

Please contact below for more information:

Hakim Juraimi

Tel: +60 12-318 5410

Email: h.juraimi@swanconsultancy.biz

Copyright 2021 ACN Newswire. All rights reserved. www.acnnewswire.com